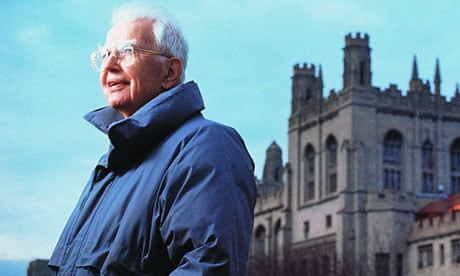

When the news broke last week that Ronald Coase, the economist and Nobel laureate, had died at the age of 102, what came immediately to mind was Keynes's observation that "practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist". Most of the people running the great internet companies of today have probably never heard of Coase, but, in a way, they are all his slaves, because way back in 1932 he cracked the problem of explaining how firms are structured, and how and why they change as circumstances change. Coase might have been ancient, but he was certainly not defunct.

As an economics student at the LSE in the 1930s, Coase was puzzled by the fact that economic theory ignored the workings of the firms that make up the economy. Economists were obsessed with the big picture – the way prices act as Adam Smith's "invisible hand", bringing supply and demand into equilibrium. But like Edwardian aristocrats disdaining "trade", they seemed blandly uninterested in the ways in which businessmen actually made decisions. "What is studied," Coase observed, "is a system that lives in the minds of economists but not on Earth."

So he got a scholarship and went to the US to examine how companies actually worked. The thing that puzzled him was this: economic theory postulated that the market provided the most efficient way of co-ordinating economic activity, and yet no large company seemed to use the price mechanism as a way of co-ordinating its internal activities. Instead, big corporations operated as command-and-control mini-economies of the kind despised by economists. How come?

"I found the answer," Coase recalled in his 1991 Nobel lecture, "by the summer of 1932. It was to realise that there were costs of using the pricing mechanism… There are negotiations to be undertaken, contracts have to be drawn up, inspections have to be made, arrangements have to be made to settle disputes and so on. These costs have come to be known as transaction costs. Their existence implies that methods of co-ordination alternative to the market, which are themselves costly and in various ways imperfect, may nonetheless be preferable to relying on the pricing mechanism, the only method of co-ordination normally analysed by economists."

It sounds simple, but it was a groundbreaking insight because it explained why, for example, companies often became vertically integrated as they grew. Transaction costs are why a manufacturer of car tyres would come to own and operate rubber plantations in some fetid tropical country; not because its executives want to farm rubber, but because the transaction costs of not owning the supplier are higher than the costs of operating it themselves.

But transaction costs explain more than just how firms operate: they also help to determine what is produced. "If the costs of making an exchange are greater than the gains which that exchange would bring," Coase wrote, "that exchange would not take place and the greater production that would flow from specialisation would not be realised. In this way, transaction costs affect not only contractual arrangements, but also what goods and services are produced. Not to include transaction costs in the theory leaves many aspects of the workings of the economic system unexplained, including the emergence of the firm, but much else besides."

Coase first outlined his discovery in a lecture at Dundee University in October 1932. He was 21 years old. His paper, The Nature of the Firm, wasn't published until 1937, though, and seems to have been largely ignored for the next half-century for reasons that only those familiar with the perversities of academic disciplines can fully understand. Whatever the explanation, the fact remained that Coase's great insight languished in relative obscurity until the internet arrived and began to wreak its havoc on the industrial system.

The thing about the net, you see, is that it reduces transaction costs, sometimes by significant amounts. The effect is not uniform and some components of transaction costs (for example the legal hassles implicit in contracts) often remain . But overall, the impact of the net on transaction costs has been dramatic. So, in a way, Coase was the spiritual godfather of legions of enterprises that would have been unthinkable in a pre-internet world. Including Linux, the open source operating system created by legions of hackers who rarely, if ever, meet face to face and yet who have created one of the wonders of the networked world. The symbol for Linux, by the way, is a penguin, which explains the title of Yochai Benkler's seminal essay on Linux, Coase's Penguin. So much for defunct economists.

Comments (…)

Sign in or create your Guardian account to join the discussion